9 Excellent How To Get An Estate Ein Number Work

5 Convert How To Get An Estate Ein Number - When your ein for an estate is ready, we will email you the results directly to your inbox. Here is what you need to do to get a federal tax id number for a deceased person’s estate:

Ein Verification Letter 147c . More specifically, the social security number, or any other tax identification number that had been assigned to and used by the deceased party, immediately stops being valid for any taxation purposes at the moment of that person’s death.

Ein Verification Letter 147c . More specifically, the social security number, or any other tax identification number that had been assigned to and used by the deceased party, immediately stops being valid for any taxation purposes at the moment of that person’s death.

How to get an estate ein number

9 Epic How To Get An Estate Ein Number. You can apply online for this number. Start estate tax id (ein) application. Yes, estates are required to obtain a tax id: How to get an estate ein number

Applying for an employer identification number (ein) is a free service offered by the internal revenue service. Verify the fact you are the executor. 2) click on the begin application button. How to get an estate ein number

Irs ein tax id number | estate of deceased individual application. Irrevocable trusts that produce income need an ein. Ad 番号取得は弊所にお任せ下さい。 itin(individual taxpayer identification number)取得サポートの段取り お客さまのご状況を詳しくお聞きし、of. How to get an estate ein number

How to apply for a tax id number (ein) during probate. We make applying for an ein easy. Your estate tax id number can be used immediately after being received, which means you can take it directly down to a bank or an accountant to complete your estate documentation. How to get an estate ein number

Apply for an employer identification number (ein) online and click on the apply online now button. Prepare information to prove you have the authority to manage the estate, including: Select your entity and fill out the online tax id application to obtain an ein number in 4 hours to 4 business days depending on the delivery method you choose. How to get an estate ein number

An employer identification number (ein) is also known as a federal tax identification number, (fein) and is used to identify a business entity, trust, estate, and various other entities. The probate court or will of the deceased will designate the representative. A decedent’s estate figures its gross income in much the same manner as an individual. How to get an estate ein number

All ein applications (mail, fax, electronic) must disclose. Before filing form 1041, you will need to obtain a tax id number for the estate. This federal tax identification number, known as an employer identification number (ein), identifies the estate to the internal revenue service (irs). How to get an estate ein number

An ein is a tax identification number that allows a trust to file its own tax return. An ein—also known as an employer identification number—is often used to identify an estate when there is an active probate. Alternative ways to get an ein for those of you launching a new business, you have another option for obtaining an ein. How to get an estate ein number

The federal tax id number for estates is called an employer identification number (ein). The deceased person’s legal name, social security number, and address. See how to apply for an ein. How to get an estate ein number

You can also apply by fax or mail; Revocable trusts generally don’t need an ein if the grantor is still alive. Before filing form 1041, you will need to obtain a tax id number for the estate. How to get an estate ein number

According to the irs, businesses need an ein in. If you don’t want to deal While there are other ways to receive an estate tax id (via mail or via fax), both of these options are less recommended. How to get an estate ein number

You can apply online for this number. You can also apply for an estate tax id (ein) number by phone, mail or fax. How to get a free ein number it’s a pretty simple process. How to get an estate ein number

A copy of the death certificate. In order to get an ein number for estate of deceased, you’ll need to prove you are the responsible party. Whether you need a tennessee ein or a kentucky tax id number, our straightforward online application means you can apply quickly and get back to your business. How to get an estate ein number

Apply for an estate tax id (ein) number by phone, mail or fax. Generally, only international applicants can apply over the phone. You can obtain an ein for an. How to get an estate ein number

5) enter information about the deceased. To find the ein for the estate of a deceased person, you must furnish the irs with the following, along with your info request: Before filing form 1041, you will need to obtain a tax id number for the estate. How to get an estate ein number

An employer identification numbers (ein) or tax identification number (tax id, or tin) is required for those who want to form a business, create a trust or an estate in the united states. Either a court approved copy of letters testamentary, or an irs form 56 if. See how to apply for an ein. How to get an estate ein number

The ein is provided by the irs and should be obtained by the personal representative or executor once the letters testamentary or letters of administration have been issued. Beware of websites on the internet that charge for this free service. 4) confirm that you want to create a tax id for an estate. How to get an estate ein number

Begin your online estate tax id (ein) application. Ein number for estate of deceased. If you are unsure about types of entities, we include simple definitions and even. How to get an estate ein number

Get your business up and running fast with our simplified process. The decedent and their estate are separate taxable entities. You can also apply by fax or mail; How to get an estate ein number

How to Get an Employer Identification Number 8 Steps . You can also apply by fax or mail;

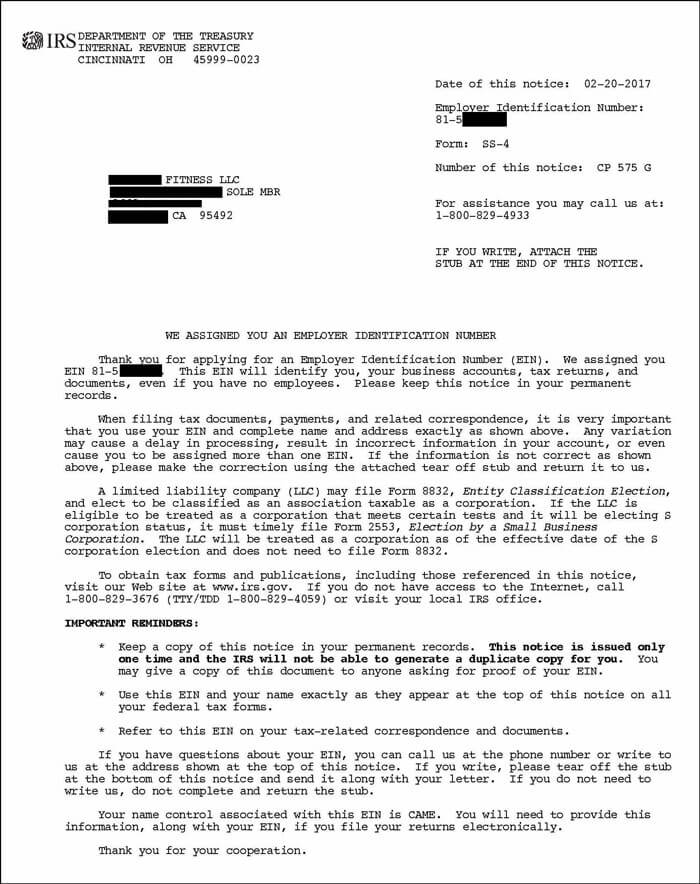

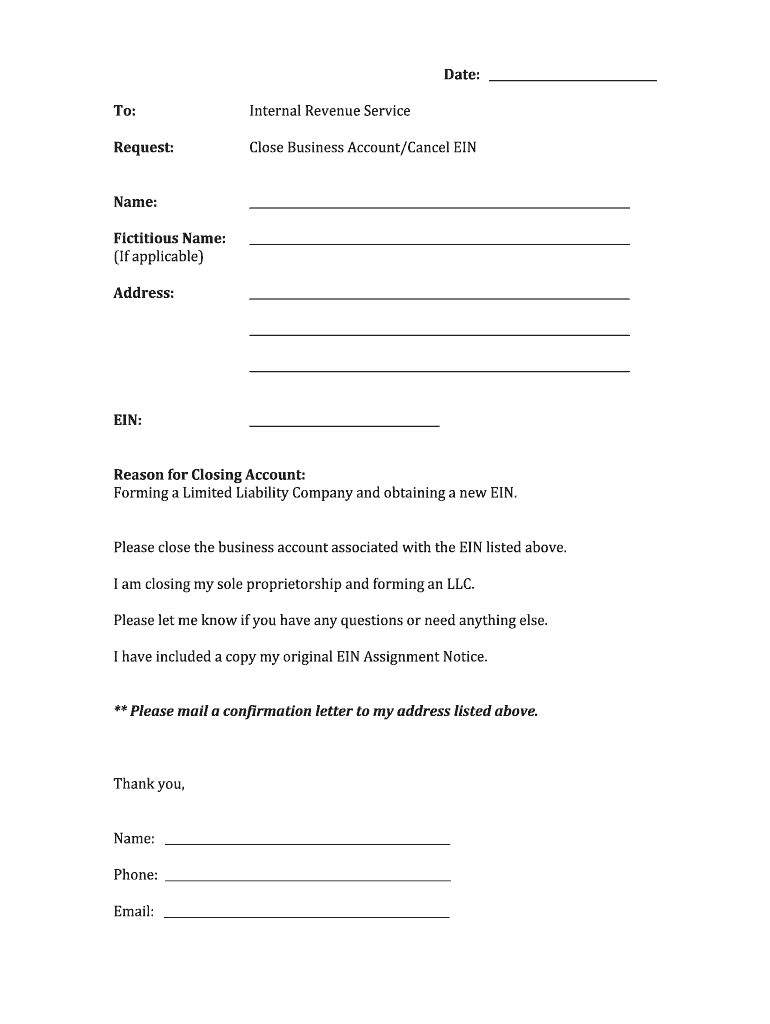

Ein Letter Fill Online, Printable, Fillable, Blank . The decedent and their estate are separate taxable entities.

Ein Letter Fill Online, Printable, Fillable, Blank . The decedent and their estate are separate taxable entities.

EIN Assignment Letter . Get your business up and running fast with our simplified process.

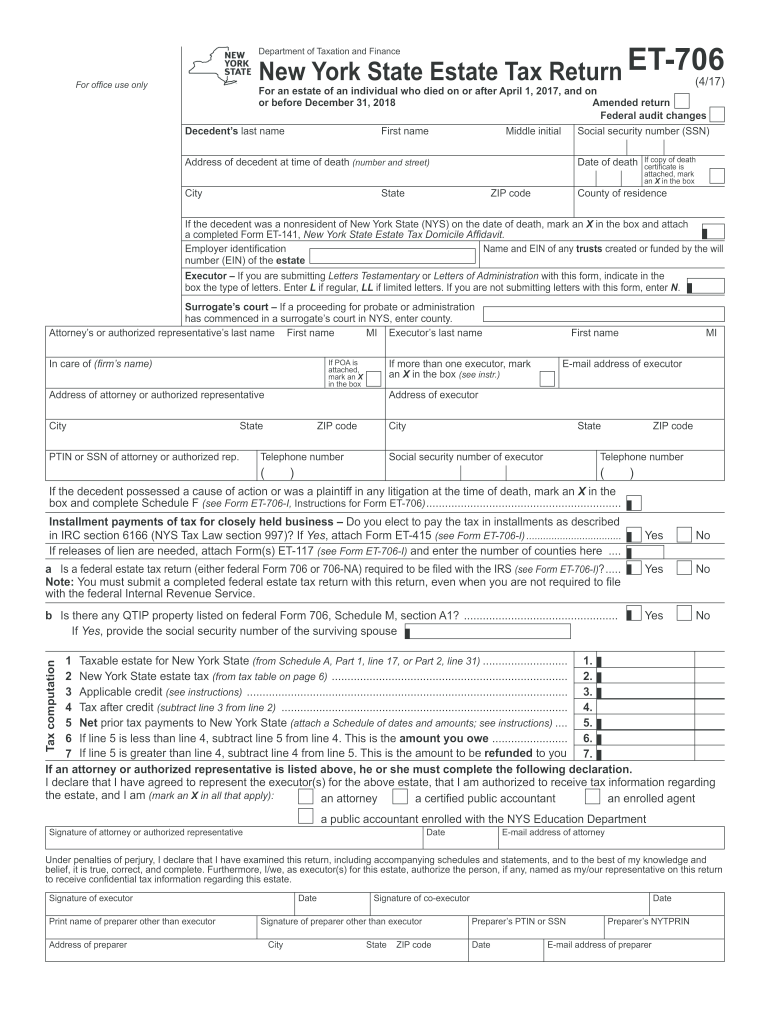

706 Gift Tax Return Form Fill Out and Sign Printable PDF . If you are unsure about types of entities, we include simple definitions and even.

706 Gift Tax Return Form Fill Out and Sign Printable PDF . If you are unsure about types of entities, we include simple definitions and even.

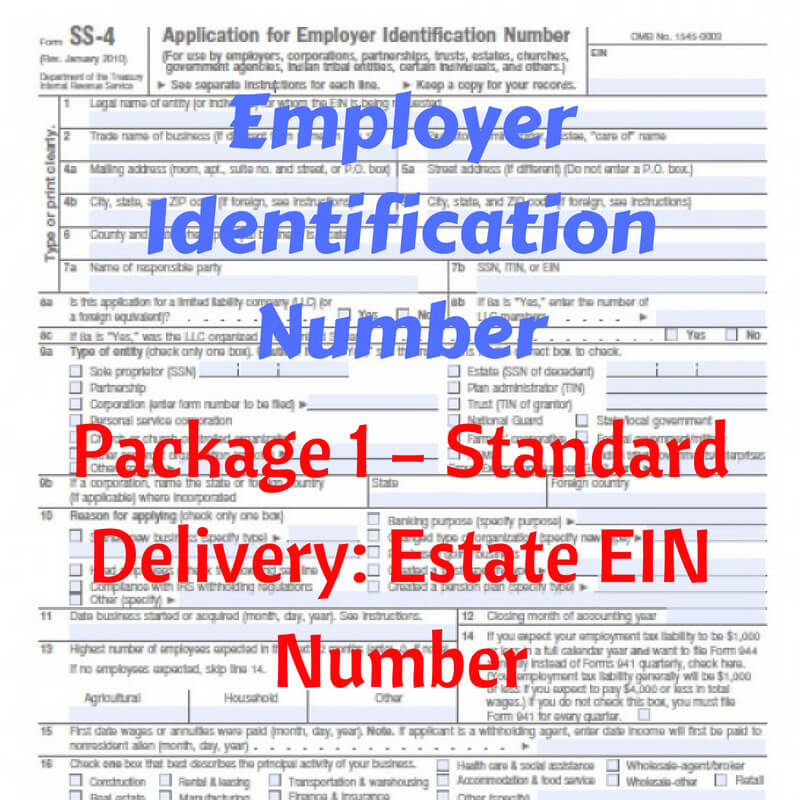

EIN Package 1 Standard Delivery Estate EIN 129.99 . Ein number for estate of deceased.

EIN Package 1 Standard Delivery Estate EIN 129.99 . Ein number for estate of deceased.

TAXES EXPLAINED How to get a Federal Taxpayer . Begin your online estate tax id (ein) application.

TAXES EXPLAINED How to get a Federal Taxpayer . Begin your online estate tax id (ein) application.