8 Absolute How To Find Out Your Tax Return Full

5 Classified How To Find Out Your Tax Return - How to lodge your tax return. How to track your money with free irs tools after you've filed your 2021 tax return, don't stress waiting for your tax refund.

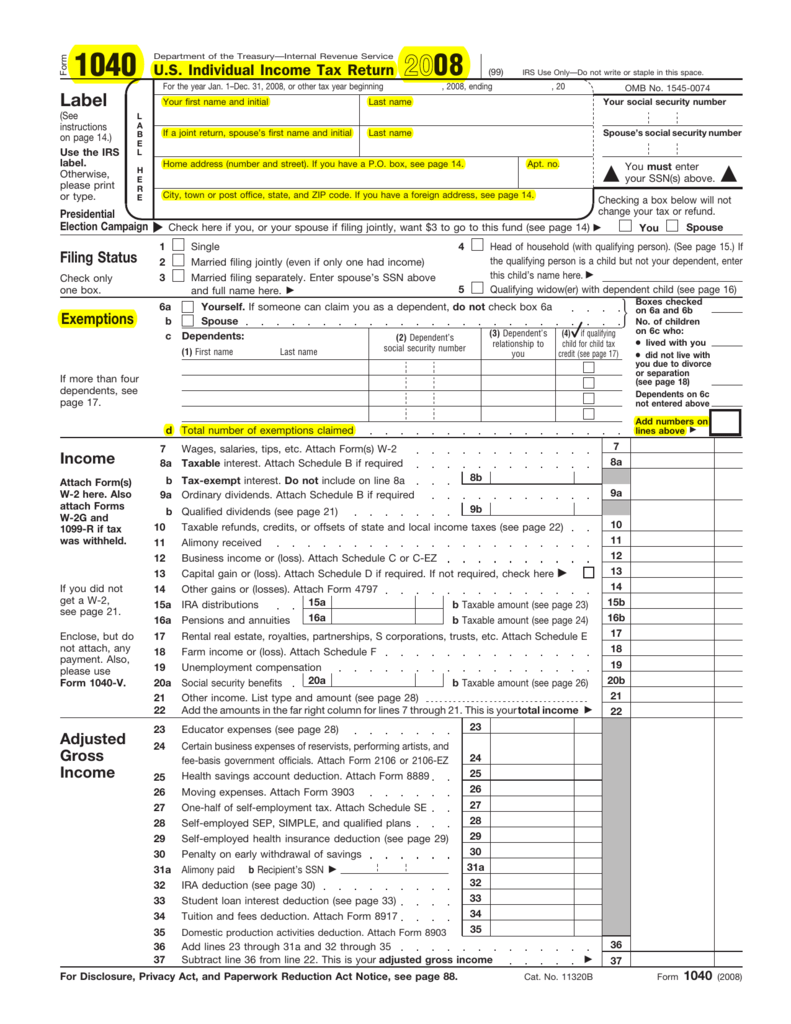

1040 U S Individual Tax Return Filing Status 2021 . File a federal income tax return the irs began accepting and processing federal tax returns on january 24, 2022.

1040 U S Individual Tax Return Filing Status 2021 . File a federal income tax return the irs began accepting and processing federal tax returns on january 24, 2022.

How to find out your tax return

13 Succeed How To Find Out Your Tax Return. If you need to complete a tax return you must lodge it or engage with a tax agent, by 31 october. (see more below.) enter your You can lodge online using mytax, through a registered tax agent or complete a paper tax return. How to find out your tax return

Find out what happens if you’re late sending your return or paying your tax. If you’re filing your own taxes: Find out what to do if you don’t get your w2 on time, and learn how to request How to find out your tax return

Learn about 2020 tax forms, instructions, and publications. To get your tax return started, you'll first need to find out how much money you made in 2021. We process paper tax returns manually and this can take up to 10 weeks (may take up to seven weeks to show on our systems). How to find out your tax return

Viewing your irs account information. Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior year’s tax return to verify their identity. Get your tax forms make sure you have the forms you need to file your taxes. How to find out your tax return

Bring your 2019 return to your tax appointment. If your tax return requires manual checks processing it may take longer. Get tax information and tools for individuals to plan, file and pay your taxes. How to find out your tax return

Your taxable income determines your tax bracket and your total tax liability. Most tax returns lodged online are processed within two weeks. The ssa will issue social How to find out your tax return

4 weeks after you mailed your return. Which method you use may depend on whether you submitted the return electronically or in the mail, and whether or not you're expecting a refund. Using the irs where’s my refund tool. How to find out your tax return

Find out what you need to report as income and where to enter it on your tax return claiming deductions, credits, and expenses find deductions, credits, and expenses to reduce the amount of tax you have to pay Figure out your 2019 earned income. Will display the status of your refund, usually on the most recent tax year refund we have on file for you. How to find out your tax return

How do i find out if my tax return was accepted? This is important to determine correctly. When you lodge a tax return you include how much money you. How to find out your tax return

There are several ways to find out if the irs has received your tax return. Online account allows you to securely access more information about your individual account. Once the 'view filed returns' option is selected, then. How to find out your tax return

Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Taxpayers can learn more about how to verify their identity and electronically sign tax returns at validating your electronically filed tax return. After you fill out your details and submit, the status will be displayed on your screen. How to find out your tax return

Your tax return covers the income year from 1 july to 30 june. Work out if you need to lodge a tax return what's new for individuals how to lodge your tax return help and support to lodge your tax return check the progress of your tax return correct (amend) your tax return income you must. Filling in your return you need to keep records (for example bank statements or. How to find out your tax return

Find your 2019 tax return. We'll show you how to figure out when it's coming. Reconcile child tax credit payments if you got advance payments of the child tax credit, find how to reconcile the payments on your 2021 federal tax return. How to find out your tax return

How to Find Out How Much You Paid in Taxes on Your 1040 . Reconcile child tax credit payments if you got advance payments of the child tax credit, find how to reconcile the payments on your 2021 federal tax return.

How to deduct maintenance payments in your German tax return? . We'll show you how to figure out when it's coming.

How to deduct maintenance payments in your German tax return? . We'll show you how to figure out when it's coming.

Free Dutch Tax Return Webinar, February 17 2022 . Find your 2019 tax return.

Free Dutch Tax Return Webinar, February 17 2022 . Find your 2019 tax return.

How To Efile Tax Return Through Net Banking . Filling in your return you need to keep records (for example bank statements or.

How To Efile Tax Return Through Net Banking . Filling in your return you need to keep records (for example bank statements or.

Fill Free fillable Form 4 2020 Personal Tax Credits . Work out if you need to lodge a tax return what's new for individuals how to lodge your tax return help and support to lodge your tax return check the progress of your tax return correct (amend) your tax return income you must.

Fill Free fillable Form 4 2020 Personal Tax Credits . Work out if you need to lodge a tax return what's new for individuals how to lodge your tax return help and support to lodge your tax return check the progress of your tax return correct (amend) your tax return income you must.

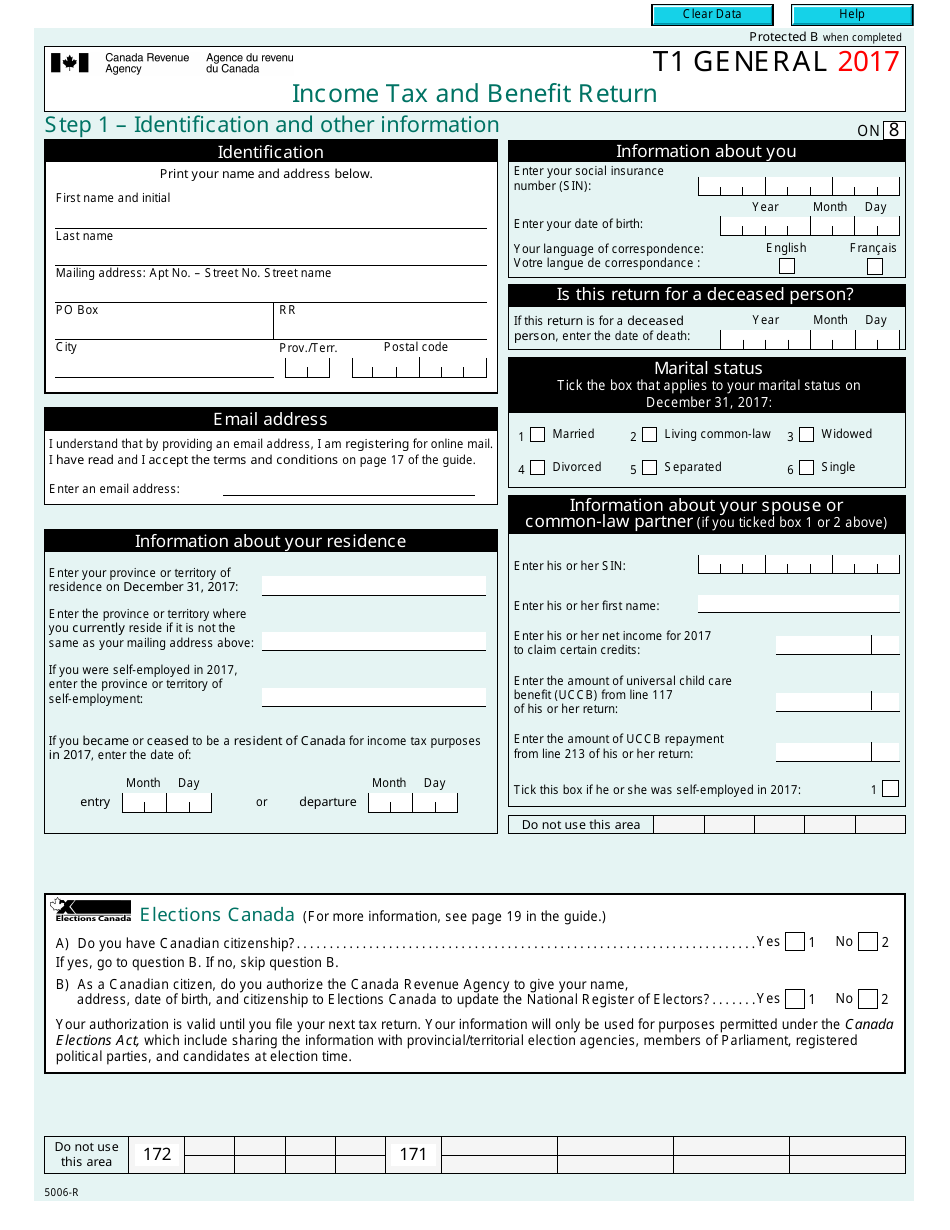

Form T1 GENERAL Download Fillable PDF or Fill Online . Your tax return covers the income year from 1 july to 30 june.

Form T1 GENERAL Download Fillable PDF or Fill Online . Your tax return covers the income year from 1 july to 30 june.