10 Tricks How To Calculate Depriciation Work

8 Trusting How To Calculate Depriciation - Taking depreciation expenses each year is a way to reduce your business tax bill. Subtract that number from the original value of the asset for depreciation value in year one.

Depreciation in Excel Excelchat Excelchat . Learn how to calculate depreciation here.

Depreciation in Excel Excelchat Excelchat . Learn how to calculate depreciation here.

How to calculate depriciation

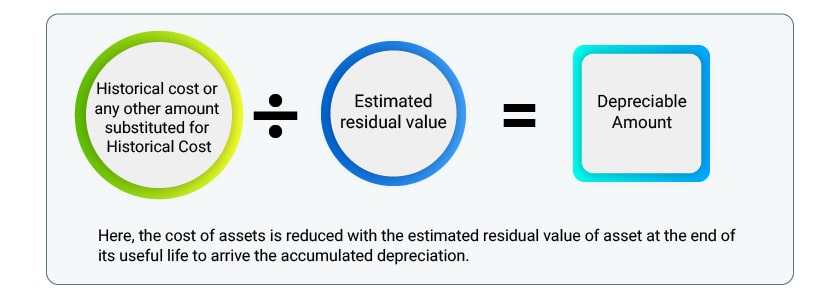

5 Hidden How To Calculate Depriciation. Subtract the new number from year one's value. Rupali burde#annuity #depreciation #bcom #firstsem The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. How to calculate depriciation

Salvage value is also known as scrap value. To calculate the cost per unit, add all of your fixed costs and all of your variable costs together and then divide this by the total amount of units you produced during that time period. The asset’s cost is either its acquisition price or its historical cost. How to calculate depriciation

Of $20,000 and a useful life of 5 years. The original price of the machinery is $5,000, the estimated useful life is 10 years, the estimated residual value is $500, and the depreciation is calculated according to the straight. Divide this amount by the number of years in the asset's useful lifespan. How to calculate depriciation

The asset must be a fixed asset like buildings, machinery, equipment, furniture, etc. If you want to assume a higher rate of depreciation, multiply by 1.5 or 2. Useful life of the asset: How to calculate depriciation

Begin with subtracting the salvageable value from the original cost. After getting this number, you need to find the percentage of depreciation. Fixed installment or equal installment or original cost or straight line method under this method, we deduct a fixed amount every year from the original cost of the asset and charge it to the profit and loss a/c. How to calculate depriciation

How do you calculate units of depreciation. Where is accumulated depreciation on the balance sheet? Multiply that number by the book value of the asset at the beginning of the year. How to calculate depriciation

Call us at 020 3441 1258 or send us an email at info@accotax.co.uk. To calculate depreciation subtract the asset's salvage value from its cost to determine the amount that can be depreciated. How to calculate depreciation on rental property now let’s take a look at a simplified example of how to calculate rental property depreciation using the straight line method of depreciation. How to calculate depriciation

The worth of an asset after it has outlived its useful life is referred to as salvage value. The video explains how to calculate both the straight line method and reducing balance met. It will calculate straight line or declining method depreciation. How to calculate depriciation

Depreciation refers to the decrease in the monetary value of physical assets over a period due to wear and tear, regular use, and obsolescence. Accotax is a dedicated firm based in morden, uk. To calculate this value on a monthly basis, simply divide the result by 12. How to calculate depriciation

Depreciation is a term that incorporates other accounting ideas, for example, how you need to calculate depreciation relies upon the business, what has been purchased, its expense, and how it was bought. Read the article to understand how it is calculated, types and its examples. This video will help you understand how to calculate depreciation. How to calculate depriciation

The straight line depreciation for the machine would be calculated as follows: The amount of years for which an asset is projected to be employed by the firm is referred to as. Depreciation is handled differently for accounting and tax purposes, but the basic calculation is the same. How to calculate depriciation

Repeat the first two steps. Estimate the asset's lifespan, which is how long you think the asset will be useful for. The cost of that asset is divided over the years evenly of its useful life by using depreciation methods. How to calculate depriciation

Divide by 12 to tell you This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property. To calculate using the sum of years technique, it starts the same as every other method. How to calculate depriciation

To calculate using this method: How to calculate depriciation

Download Calculate Double Declining Balance Gantt Chart . To calculate using this method:

Download Calculate Double Declining Balance Gantt Chart . To calculate using this method:

The Steps On How To Calculate Depreciation Steph's . To calculate using the sum of years technique, it starts the same as every other method.

The Steps On How To Calculate Depreciation Steph's . To calculate using the sum of years technique, it starts the same as every other method.

What is Accumulated Depreciation Tally Solutions . This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

What is Accumulated Depreciation Tally Solutions . This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

How To Calculate Depreciation For Rental Property BMT Insider . Divide by 12 to tell you

How To Calculate Depreciation For Rental Property BMT Insider . Divide by 12 to tell you

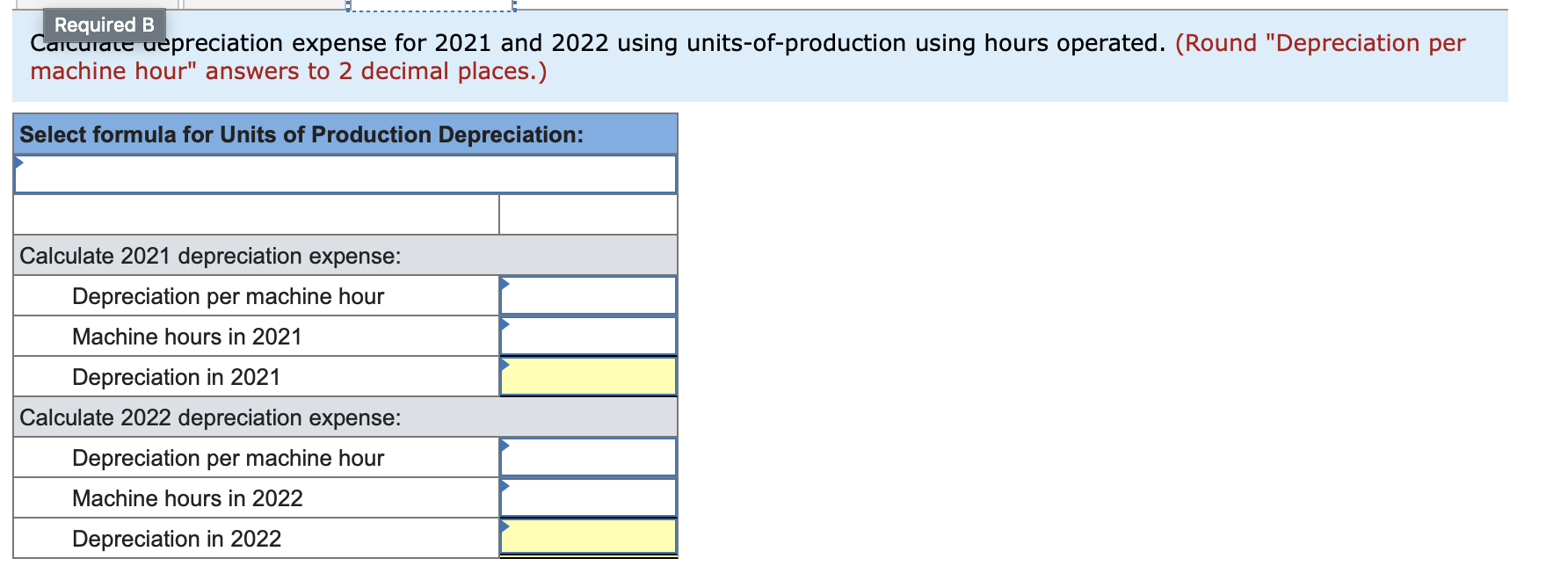

Answered Calculate depreciation expense for 2021… bartleby . The cost of that asset is divided over the years evenly of its useful life by using depreciation methods.

Answered Calculate depreciation expense for 2021… bartleby . The cost of that asset is divided over the years evenly of its useful life by using depreciation methods.

How to Calculate Depreciation on a Car The Complete Guide . Estimate the asset's lifespan, which is how long you think the asset will be useful for.

How to Calculate Depreciation on a Car The Complete Guide . Estimate the asset's lifespan, which is how long you think the asset will be useful for.